While our observation didn't start as early as last year's Black Friday 2009 review - we were taking screen shots at 6:00 v. 4:00 a.m. - we have followed up our 2009 review with insights into Black Friday 2010 related digital marketing activity. A quick recap of findings from last year:

- Large brands bought most of their traffic with few optimized for search and running relevant social media promotions (paid v. earned)

- Open competition between online and offline retailers was in full display, with online retailers winning the battle online in their domain

- The post-click experience left much to be desired, especially from those paying for traffic - largely a missed opportunity given the budgets put towards purchased eye-balls, ignoring the opportunity for "earned" attention, but hardly an odd occurrence (and thankfully - that's what keeps us employed)

- Social media integration was weak, as was integration into customer lifecycle marketing programs (email, mobile, social, etc), a missed opportunity to extend the impact of the advertising investment by incorporating ongoing relationship building post the Black Friday buzz and realizing long-term ROI

For the most part during Black Friday 2009, large brands specifically ran traditional online campaigns, paying for traffic, hoping for an immediate sale, and leaving opportunity for more relevant and deeper engagement with new prospects and existing customers on the table.

Was Black Friday 2010 any different? Yes and no, and begin.

Gentleman, Start Your Engines - Wait, You Already Did!

One of the biggest differences from 2009 to 2010 that we noticed was how early many began releasing their Black Friday 2010 deals and/or related discounts. It appears that in an effort to break through the clutter and differentiate, competitors of all sizes began releasing deals before today, an interesting trend that may prove to threaten the impact of Black Friday on the consumer mindset. Of course, the morning frenzy at brick and mortars does not appear to be in jeopardy any time soon, but many deals began early online, and sometimes offline, begging the question what meaning will days like Black Friday and Cyber Monday have over time if we as consumers are exposed to periods of "season long deals" v. one-time opportunities with perceived urgency?

Everybody and Their Mom - Mass Marketing to the Masses Online

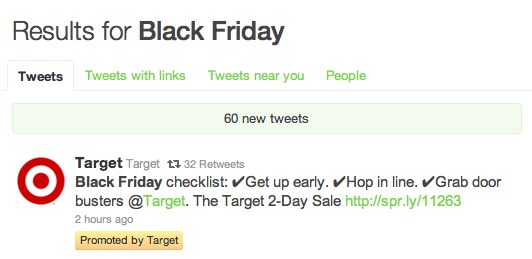

[caption id="attachment_239" align="alignleft" width="474" caption="target black friday twitter sponsored ad"] [/caption]

[/caption]

While your mother historically may have been more likely to think about Black Friday as an offline event, it is clear that advertisers in 2010 were expecting, or expecting to affect, a change in that mindset given their increased activity and apparent spend online.

Here we see a sponsored twitter listing from Target, a tactic not possible last year, with a relatively high price tag.

While more noticeable, it wasn't just large retailers advertising online. Many small and medium retailers and organizations utilized local and social channels to participate in the online marketing conversation and feeding frenzy, leveling the playing field through smart content and conversation marketing. Here we see an example from Local First AZ promoting "Local Week" an organization dedicated to promoting local merchants in a united effort to compete against large retailer budgets and reach.

Retailers were also making it easier than ever before for those more comfortable with the offline experience to have a bit of both worlds as we noticed a wide variety of retailers allowing for online purchase and in-store pick-up, a tactic used for quite some time by those who also desire foot traffic to the store for up-sell opportunities (and who practice nimble inventory movement and management across stores).

A no-brainer, but a conclusion none the less, all retailers are seeing the power of online as both a marketing tactic and conversion mechanism, and we expect to see even more tactical expansion and online competition next year for the growing online revenue we assume they are receiving.

Aggregators v. Retailers - A Guide to Sales, and Direct Competition for Consumer Attention

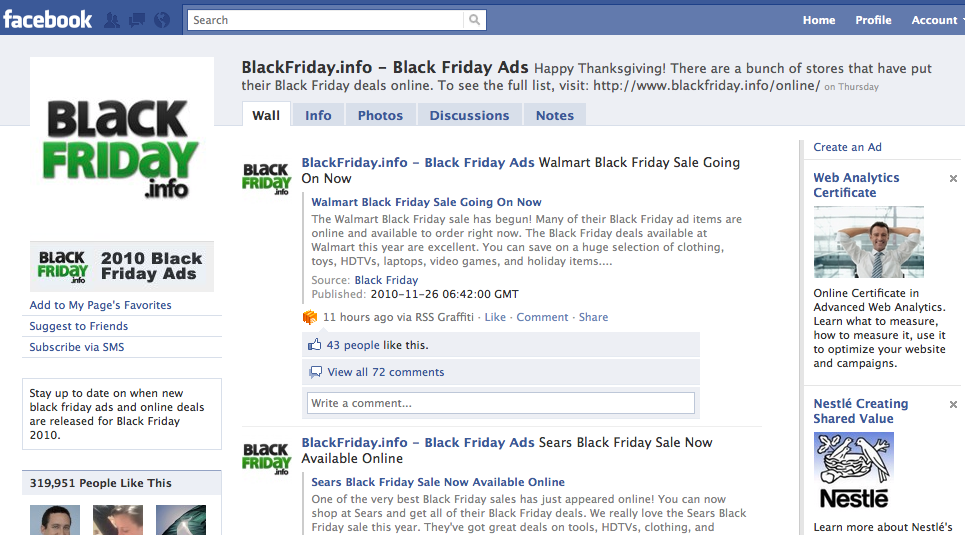

We also noticed that a plethora of aggregators like www.blackfriday.org , www.blackfriday.com , and www.blackfriday.info entered the mix at heightened levels in 2010, utilizing a full array of earned media tactics to combat traditional retailers and guide the conversation. Did it work? While we can't see true traffic results, stats like the following show at a minimum where attention is paid and where large retailers are potentially feeling the competitive pain"

We also noticed that a plethora of aggregators like www.blackfriday.org , www.blackfriday.com , and www.blackfriday.info entered the mix at heightened levels in 2010, utilizing a full array of earned media tactics to combat traditional retailers and guide the conversation. Did it work? While we can't see true traffic results, stats like the following show at a minimum where attention is paid and where large retailers are potentially feeling the competitive pain"

BlackFriday.info - 319,935 Facebook fans

Sears - 276,894 Facebook fans

Getting Down to Brass Tactics

As mentioned in last year's post, the tactical activities implemented historically by most retailers have followed the basic flow of offline ads generating interest, if that interest comes online pay for the connection through paid media channels, and then hope for a one-time sale. Beyond the addition of a few more tactics this year, not much has changed with this group.

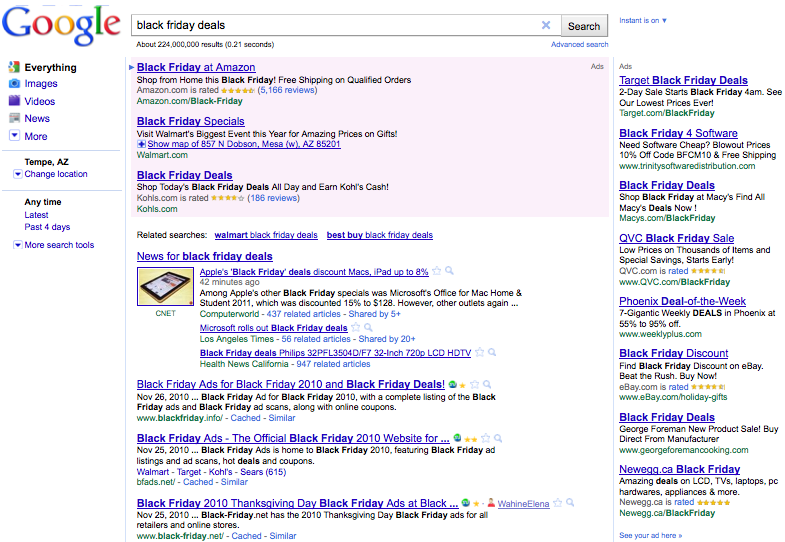

Again this year we see many of the same players dominating paid search including both online and offline retailers competing head-on:

Noteworthy, even more noticeable than last year, aggregators have dominated the earned search space where over 80% of the clicks happen, a continued missed opportunity for retailers continuing to pay for traffic they could earn with permanent content and strategic content marketing strategies across the web and blogosphere given the power of their sites and outposts across the web.

Big-Box Retailers: This year, we saw a slightly wider variety of tactical executions, but much of the previous year's strategy, especially from the big box retailers like Sears, JCPenney, Target and Walmart. While each had displayed tactical expansion, few have fully leveraged earned and owned media to the extent possible, again relying on brand recognition and ad budgets to do the heavy lifting.

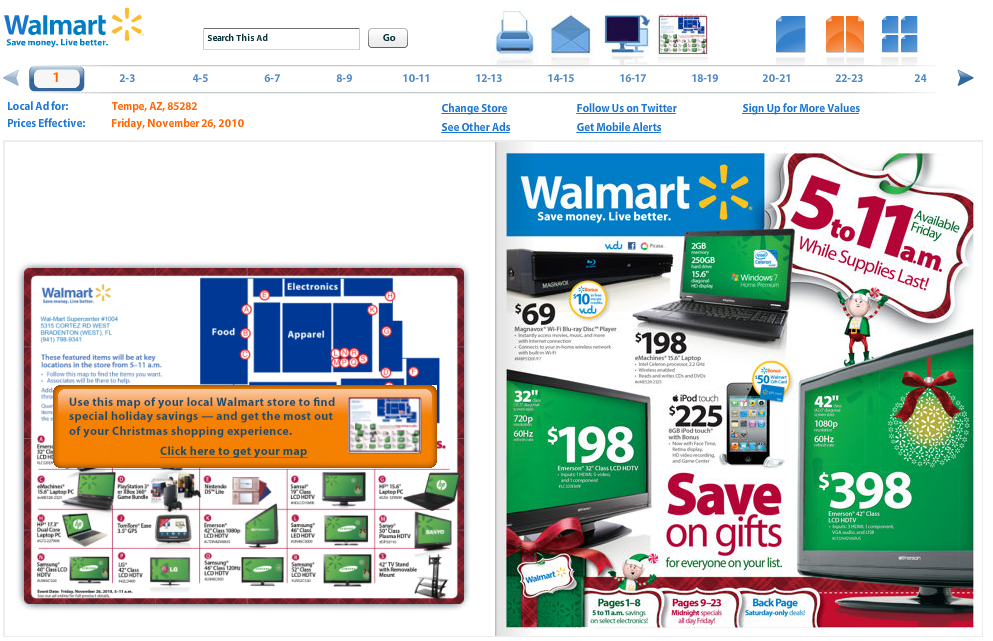

Walmart held a relatively steady position in comparison to last year, missing the opportunity to expand reach and effort through new mediums. In terms of websites, Walmart continued to essentially post its offline ads online.

This treatment was overly blah, missing the opportunity to connect with consumers on a deeper level. Walmart did create a sense of urgency, messaging that the deals were good for today only, but missed the chance to spread messaging and promotion through its user base and create brand loyalty.

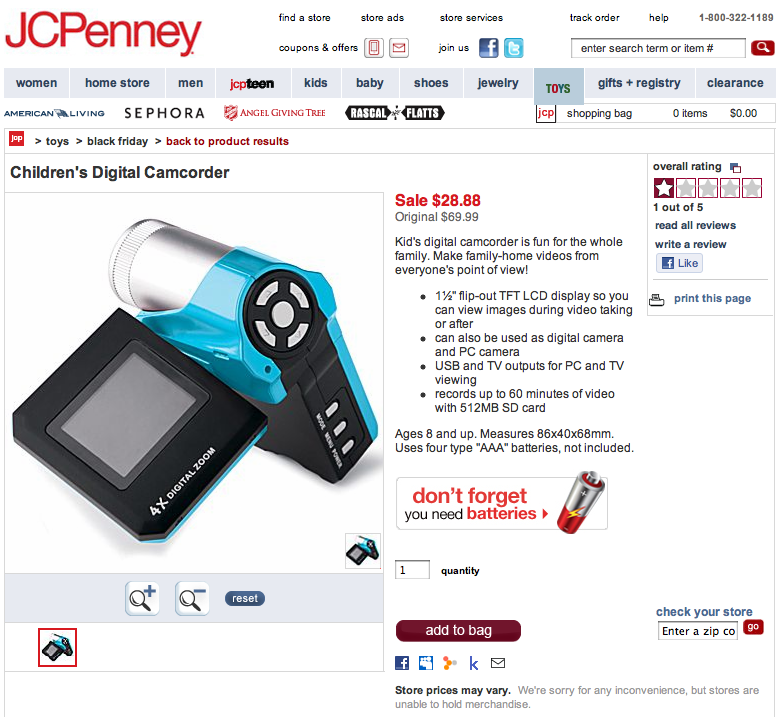

Some areas of website growth included better Facebook integration. While much more is possible, JCPenney integrated Facebook's " like" functionality allowing web visitors to inform their networks about a product they found interesting.

JCPenney did the best job in the competitive set in fact, also allowing visitors the ability to share their finds in other social networks.

Better than a general share this button, JCPenney is informing visitors that their Facebook presence is the place to interact with the brand, also nudging the visitor to add brand reach in their desired social network.

In social, all big box retailers received some mention and orchestrated various levels of Black Friday attention, though the effort was not well maintained by any with many opportunities for direct engagement on pages wasted. Some did have a Black Friday tab, even setting it to be the entry to the brand experience for the last few days, a definite recommendations for all.

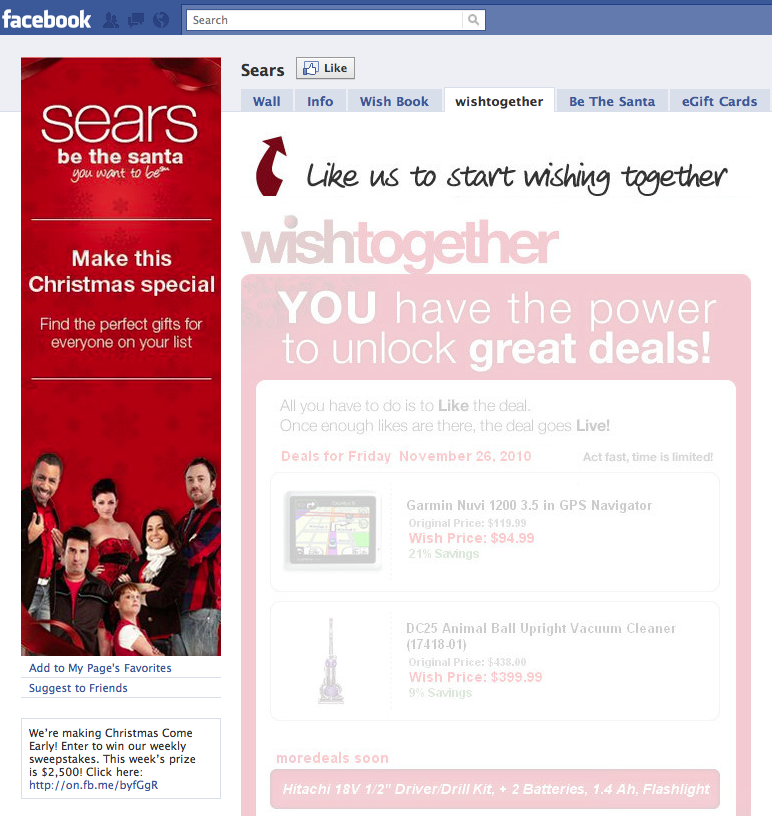

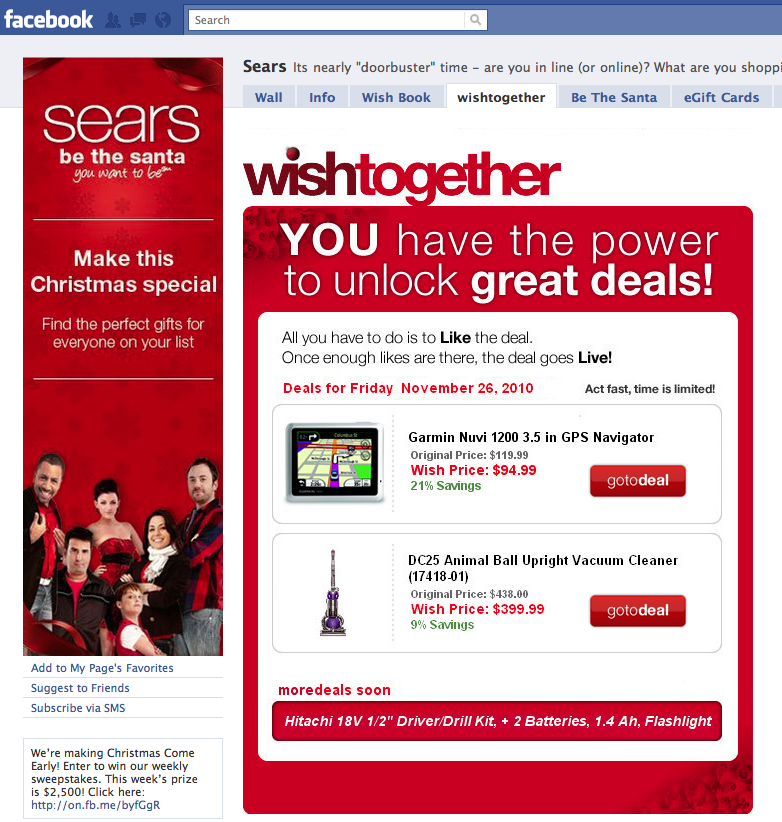

Of note, Sears did a great job obtaining fans and enticing fan deal participation through their "wish together" holiday themed Facebook promotion.

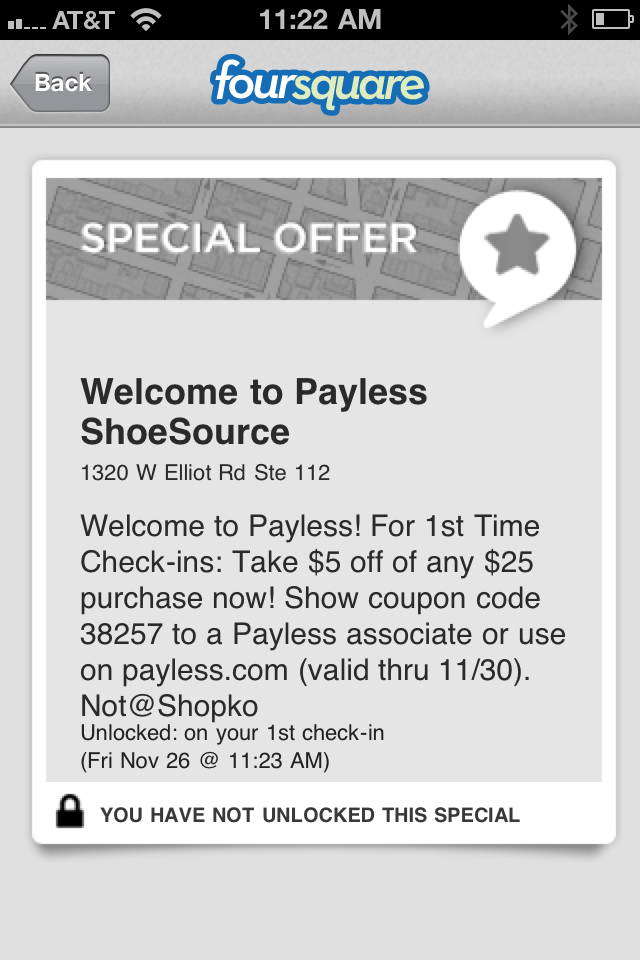

On a local level, Walmart, like its competitors we were able to view (we did not for the record visit the locations of all on the list and likely missed examples of some participation) also missed the boat, with more savvy marketers taking advantage of the situation.

In 2010, Target Raised the Bar:

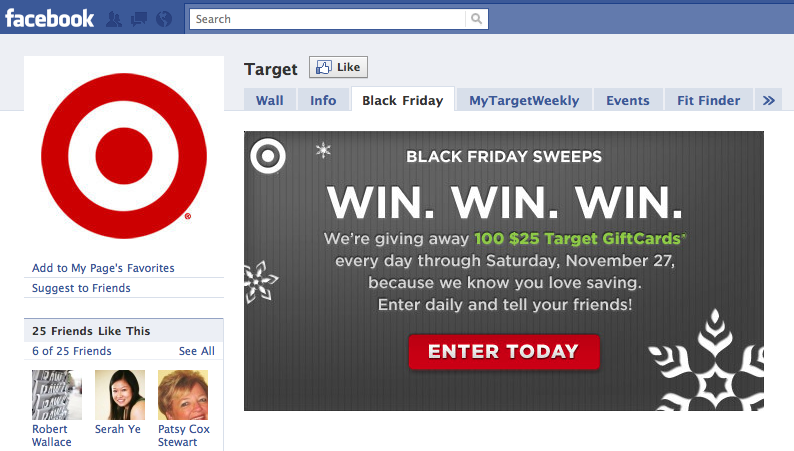

Of the big-box retailers, Target exceeded the efforts of the competition by expanding its into many new mediums, and prioritizing consumer relationship building for the long-term. As aforementioned, Target expanded paid activity to include a twitter sponsored presence. Target also continued to promote customer lifecycle activity and connections through website conversions like mobile and email calls to action. Target also had the most relevant Facebook presence, highlighting its Black Friday activities and enticing consumers with a related promotion which was integrated through all digital touch points, and evidenced here

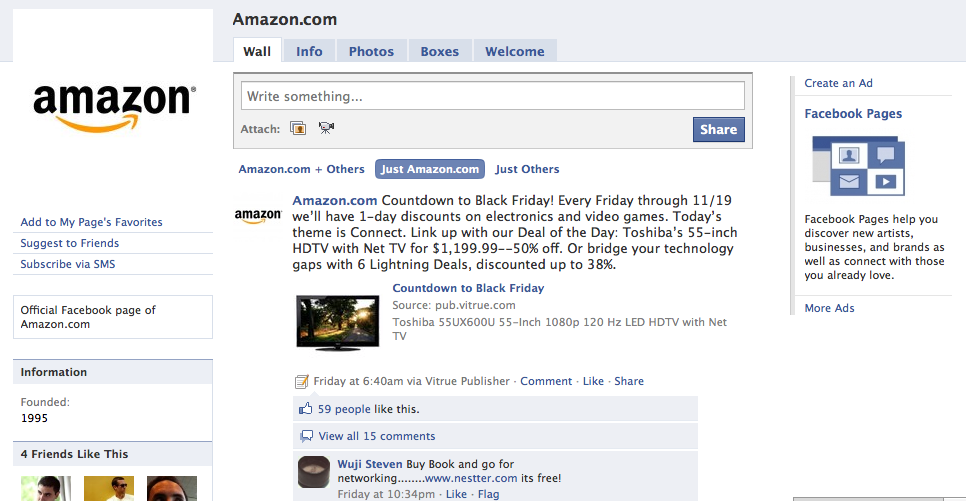

Online Retailers: Like last year, the leaders in terms of innovation and perceived effectiveness were the online retailers. Players like Dell and Amazon continued to push the envelope, integrating their websites with their social outposts, and effectively buying targeted media to walk prospects through the process.

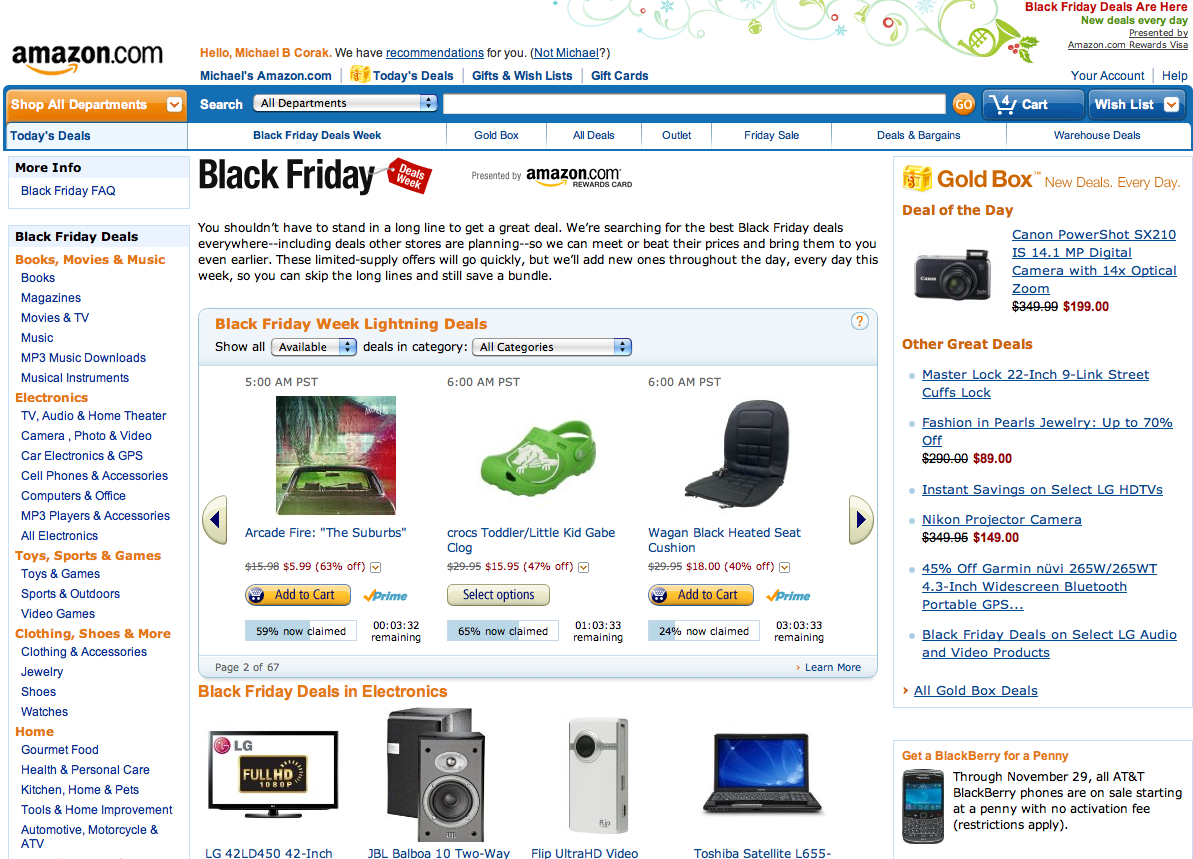

Amazon especially excelled, clearly defining their communication channels and directing users to their place of interest based on the purposed topics and themes (see Amazon's Facebook presence, its @amazondeals twitter account, website and more).

Amazon also excelled at website enhancement. The titans of innovation and testing, Amazon added new features to the site to display current Black Friday offers with inventory display, expired offers and upcoming deals. Effectively creating a reason to engage across the web Amazon is this year's Black Friday leader in online retailing, pitting a competition between Target and amazon.com for first in 2011.

But of course, this is merely our opinion, and revenue numbers aren't here allowing us to see the real proof. Who do you think took home the prize? What efforts were noteworthy for you?

[caption id="attachment_101" align="alignleft" width="56" caption="Mike Corak"] [/caption]

[/caption]

Mike Corak leads the strategic planning operations Tallwave, and is co-founder of www.digitalmarketingstrategy.com. An active member of the digital marketing community and frequent blogger and speaker, Mike's passion is interactive marketing. Mike's developed and implemented winning digital and integrated strategies for hundreds of companies over his 12 year career including the likes of Coca Cola, ConAgra Foods, ConocoPhillips, FedEx, Fujitsu, Nike, Office Depot, and Walt Disney. Contact Mike at mikecorak@gmail.com, or interact with Mike here: twitter, LinkedIn.